Multifamily AI Integration

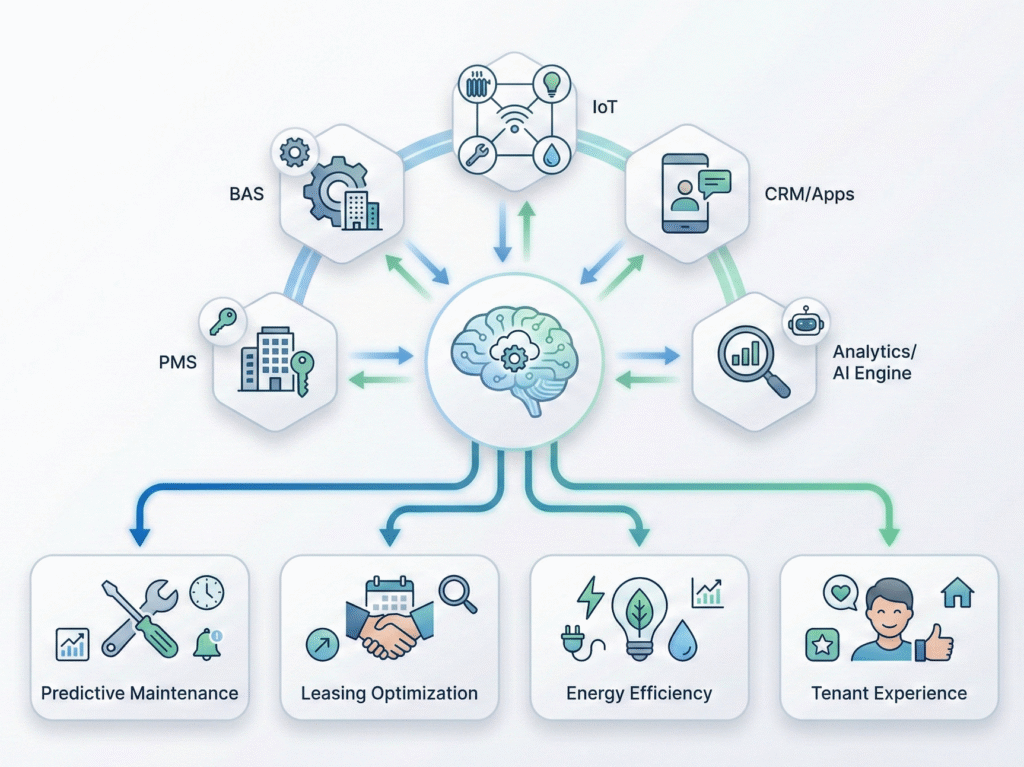

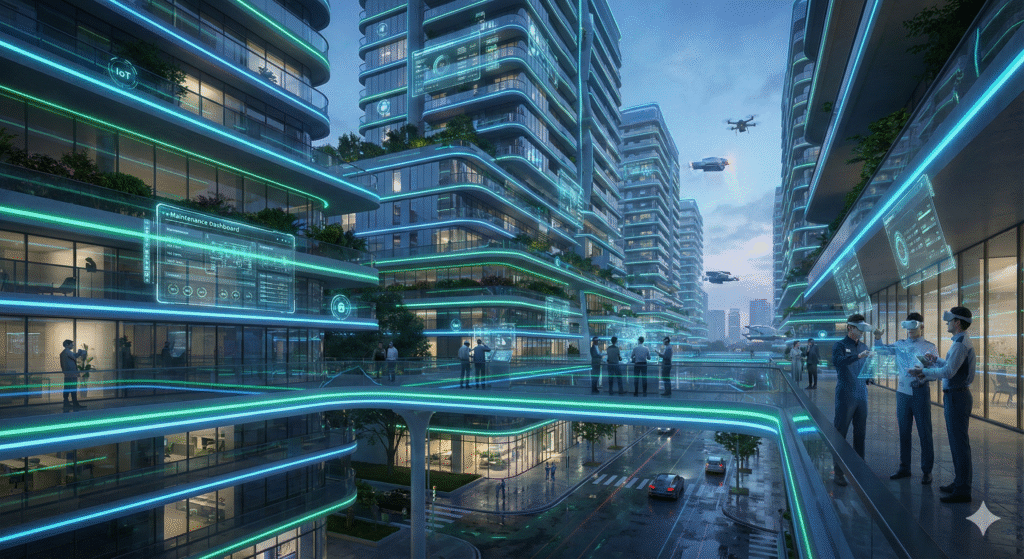

Multifamily real estate has evolved beyond units and leases—it’s now a dynamic data ecosystem. Today’s top-performing operators aren’t just those with the largest portfolios; they’re the ones who leverage AI integration multifamily strategies to unify their technology, consolidate data streams, and optimize operations. By connecting PMS, BAS, analytics platforms, and resident engagement tools, these operators […]

Maximizing Multifamily Value with AI-Driven Resident Experience

At Evolve Development Group, we understand that the future of multifamily real estate is resident-centric. Building on insights from our previous discussion on AI tenant experience, the next step for investors and developers is leveraging AI to not only reduce turnover but to maximize long-term property value. Why AI-Driven Resident Experience Matters for Investors Tenant […]

Stop Losing Millions: Predictive Maintenance AI Boosts Multifamily NOI

Multifamily operators quietly lose 2–4% of NOI every year—thanks to reactive maintenance, siloed systems, and missed alerts (Showdigs, 2025). The solution in 2025: AI-powered predictive maintenance. Why It Matters Buildings generate mountains of data—temperatures, vibrations, runtime metrics. AI monitors it 24/7, spotting issues humans miss. The result (Mev, 2025; Keyway, 2025): 20–30% fewer emergency maintenance […]

How AI Is Redefining Multifamily Performance: A New Model for Operational Excellence

Across the multifamily sector, owners and value-add investors routinely watch 2–4% of their potential NOI disappear each year. The cause isn’t market dynamics—it’s avoidable operational drag. Slow human workflows, reactive maintenance, and siloed building systems quietly erode millions in value portfolio-wide (NAREIT, 2024; Convin, 2025). At Evolve Development Group, Tyson Dirksen and our team treat […]

Healthy Buildings, High Performance: Why Indoor Air Quality Should Drive Real Estate Value

By Tyson Dirksen, Founder of Evolve Development Group Indoor air quality (IAQ) is no longer optional — it is a core driver of occupant health, asset performance, and investor value. Recent studies underscore that indoor pollutant exposure from sources like gas stoves can account for up to a third of total household Nitrogen Dioxide (NO₂) exposure (SFGate, […]

Stumbling Upon Opportunity: Why Nicaragua’s Emerald Coast Is the Next Pre-Boom Destination

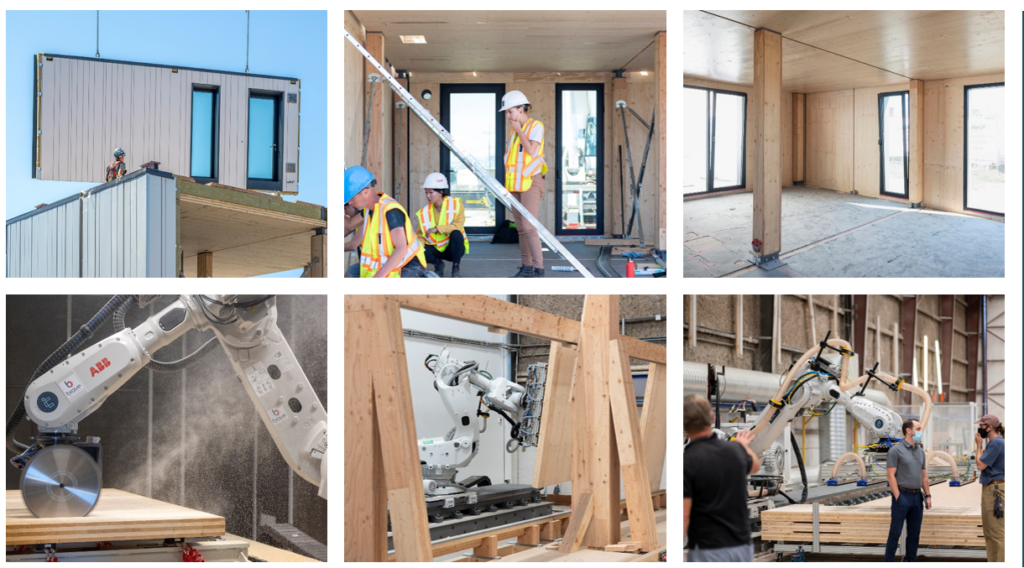

At Evolve, we’re all-in on the future: AI-powered prefab, mass timber, industrialized construction, Passive House efficiency, and wellness-driven living. But occasionally, a market emerges with undeniable energy and first-mover potential. Nicaragua’s Emerald Coast is exactly that — world-class surf, Papagayo winds to create perfect surf, pristine beaches, volcanoes, beachfront jungle, incredible food culture, and rich […]

Why Construction Productivity Matters — and What It Means for Evolve Development Group

At Evolve Development Group, understanding macro trends is essential to delivering value—for investors, communities, and our projects. One under‑appreciated trend in real estate development is the persistent decline in labor productivity within the construction sector. While the broader U.S. economy has seen productivity nearly double since the 1970s, construction labor productivity has fallen by more […]

Affordable Housing Development Financing: Strategies for Success

Affordable housing development financing is essential for turning visionary projects into lasting communities. At Evolve Development Group, we help developers and investors navigate the complex capital stack, ensuring projects succeed from construction through long-term operations. 1. Assemble the Right Capital Stack Affordable housing development financing starts with a well-structured capital stack. Key elements include: Construction […]

Affordable Housing Financing with Tyson Dirksen and Evolve Development Group

Affordable housing financing is central to successful real estate development, and at Evolve Development Group, we specialize in making complex projects feasible. Led by Tyson Dirksen, we combine LIHTC, construction loans, and strategic gap financing to create affordable housing that delivers lasting value. Construction Loans and Debt Strategies Securing construction loans for affordable housing is […]

Why Secondary Cities Are the New Frontier for Real Estate Investment

By Tyson Dirksen, Founder of Evolve Development Group For two decades, America’s real estate narrative has centered on gateway cities like San Francisco, New York, and Los Angeles. But today, the strongest demographic, housing, and economic tailwinds are emerging in a different category altogether—fast-growing, economically resilient secondary cities. These markets are now outperforming traditional coastal […]